INSURANCE ADVISORY

At ‘V’ we believe in providing curated insurance solution to individuals and corporates in order to provide a strong protection shield for the individual and his family. Insurance acts as a precautionary investment that shelters you from financial loss in case of any uncertain event. We deal in a novice concepts in insurance like MWPA, Employer Employee Programs, Estate Planning etc.

- Risk Management

- Secure Future Goals

Traditional Policy

Traditional policies are a type of life insurance plan that provide multiple benefits such as risk cover, fixed income return, safety and tax benefit. They cater to individuals with a low-risk appetite.

Market Linked Policy

The insurer pools money from all the policyholders and invests the same in the funds chosen by them. Once the money is invested, the total corpus is divided into ‘units’ with a certain face value. Each investor is then allocated ‘Units’ in proportion to the invested amount.

TYPE OF INSURANCE

0%

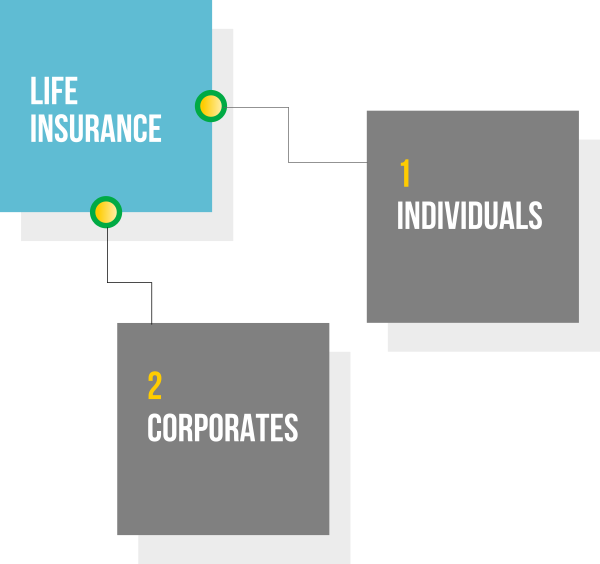

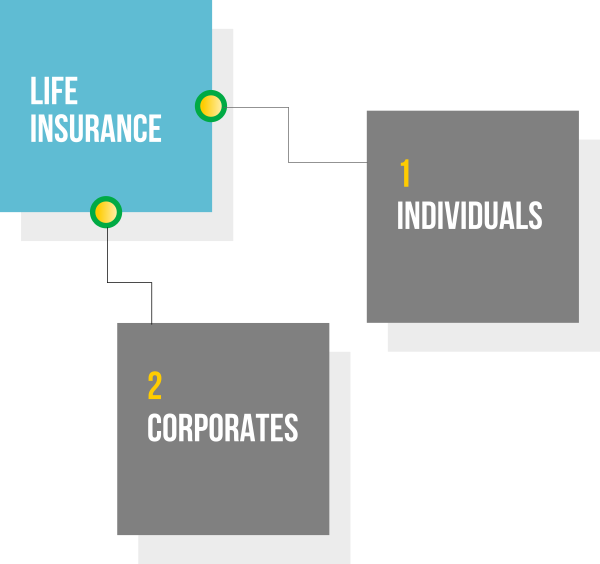

Life Insurance

V-Financial provides an umbrella of life insurance to ensure that your family receives financial support at all milestone/stages of life. Along with providing a protective shield, insurance also provides flexibility through investment schemes thus empowering you to accumulate more wealth, save on taxes, estate planning & stress-free retirement life.

INDIVIDUALS

Life Insurance

Life insurance aids you in life stage planning where you can plan your life’s financial goals at your convenience. It helps you plan for your life stage needs. Life Insurance not only provides financial support in the event of untimely death but also acts as a long term investment.

Term insurance protects your family’s financial future if something were to happen to you. Designed as a simple and affordable way to give financial cover, a term plan is a vital part of financial planning for the primary wage earner in a family.

A unit linked insurance plan (ULIP) is a combination of insurance and investment. A ULIP provides life cover that offers financial protection for

your loved ones. In addition to this, it also gives you the potential to create wealth through market-linked returns from systematic investments.

Endowment policies are one of the types of life insurance policies that provide you with the combined benefit of life insurance and

savings. Along with giving you the life cover, these types of life insurance help you save money regularly over a period to get a lump sum at maturity.

This life insurance policy gives periodic payments during the term of policy. In other words, a portion of the sum assured is paid out at regular intervals. If the policyholder survives the term, he gets the balance sum assured.

A Whole Life Insurance policy provides insurance coverage to the to the insured for the entire life up to 100 years of age. Typically, the death benefit, under a whole life insurance, is payable to the beneficiary in the case of the untimely demise of the policyholder. On the other hand, you are eligible to receive a maturity benefit under a whole life insurance policy if you cross 100 years of age.

These types of Insurance Policies, the insurer agrees to pay the insured a stipulated sum of money periodically. The purpose of

an annuity is to protect against financial risk and Inflation as well as to provide money in the form pension at regular intervals.

0%

Motor Insurance

Motor insurance is a unique insurance policy meant for vehicle owners to protect them from incurring any financial losses that may arise due to damage or theft of the vehicle. It is an insurance policy for all types of two-wheelers and four-wheelers such as cars, bikes, scooters, and trucks that are plying the routes of India.

0%

Health Insurance

Health insurance is an insurance product which covers the medical and surgical expenses of an insured individual. It reimburses the expenses incurred due to illness or injury or pays the care provider of the insured individual directly.

You can purchase an individual health insurance policy to provide cover for yourself, your spouse, your children and your parents. These policies typically cover all kinds of medical expenses, including hospitalisation, daycare procedures, hospital room rent and more. Under an individual health insurance plan, each member has their own sum insured amount.

A Family floater plan allows you to cover your family members under one policy where everybody shares the sum insured amount

0%

MWPA

At ‘V’ we always advice our clients to bring their policy under the purview of Married Women’s Property Act 1874. To ensure that only the dependents of the life assured receive the proceeds (insulated corpus), not the creditors. To ensure that the customer and his family get what rightfully belongs to them under any circumstances.

CORPORATES

0%

Group Credit Insurance

With credit life insurance scheme you can establish yourself as a caring lender by show casting that the family of the borrower neither needs to go through the hassles of loan repayment and also it protects the lender against loan default in the event of borrower’s death. This ensures interest of both parties are kept intact.

0%

Group Term Insurance

Group Term Insurance provides life cover to group of people through one master policy covering all members of the groups. A convenient way to manage the risk cover of large number of persons as addition and deletion of members can happen anytime during the year

0%

Group Medical Cover

V-Financial provides various planning options under the employee benefit schemes. V provides group insurance which are quite cost effective for employer and take care of the medical needs of the employee in quite comprehensive manner. The policy covers indemnifications of medical expenses incurred by the insured during hospitalizations, any illness or injury suffered in India.

Pre and Post hospitalization medical expenses can be covered for up to 30 and 60 days. It covers age from 91 days old to 80 years.

It can be of two types:

- Non employer - employee group: This may include members of registered welfare associations, holder of credit cards, customers of particular business when insurance is offered as an add on benefit

- Employer – Employee Group: This includes employees of any specific registered organisation

0%

Employer Employee Insurance

Employer Employee Insurance is a unique opportunity for the employer to reward his employee and get benefited at the same time. This scheme helps to secure the financial future of the employees in the event of an unforeseen event.

0%

Keyman Insurance

The business is run by experienced and skilled individuals to plan, execute and implement business decisions so that the business can grow. There may arise a situation where the key person responsible for the growth of business dies and the business can face substantial loss. ‘V’ advice our clients to avail the Keyman insurance policy which covers this loss suffered by business. This policy offers financial cushion to set off the liabilities and avoid financial crisis.